The lower cost of borrowing and higher income levels allowed more Californians to afford to purchase a home during the third quarter of 2019. That’s according to data from the California Association of Realtors.

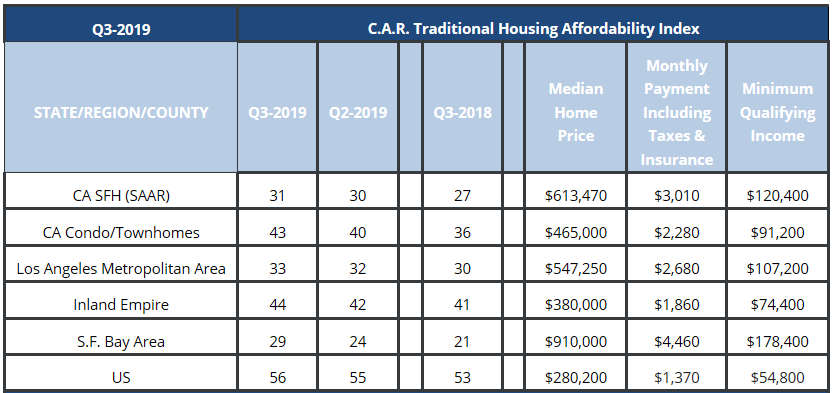

Surprisingly, the percentage of home buyers who could afford to purchase a median-priced, existing single-family home in California in third-quarter 2019 edged up to 1% to 31%.

So, here are the numbers…

A minimum annual income of $120,400 was needed to qualify for the purchase of a $613,470 statewide median-priced, existing single-family home in California.

The monthly payment, including taxes and insurance on a 30-year, fixed-rate loan, would be $3,010. That’s assuming a 20% down payment and an interest rate of 3.85%.

Download the Affordability Report Here:

- Notably, the most affordable counties in California were Lassen, Kings, and Madera. The minimum annual income needed to qualify for a home in these counties was less than $56,000.

- By contrast, Mono, San Francisco, and San Mateo counties were the least affordable areas in the state.

Show Prep Source:

https://www.car.org/marketdata/data/haitraditional

Recent Show Prep Articles:

- In Hot Market, ‘Full House’ Home in San Francisco Sells for Less Than Asking

- New Buyers Feel They Can Afford More. Here’s Why.

- Good News for Homeowners; Home Prices Rocket in Third Quarter

- COVID-19 Has Impacted Home Purchasing Plans. This is How…

- Couple Rescued After Hurricane Blows Home off it’s Stilts