For some homebuyers, housing affordability improved in the last 12 months.

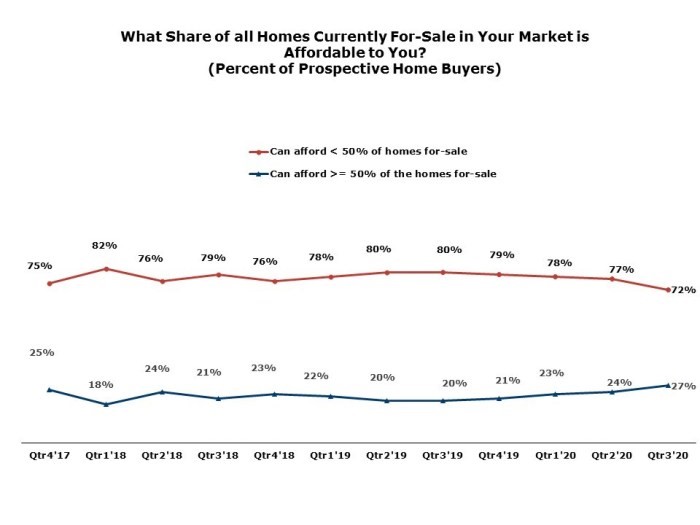

According to the Housing Trends Report for the third quarter of 2020, 27% of buyers report being able to afford half or more of the homes available-for-sale in their markets.

A year earlier, that share was 20%.

The National Association of Homebuilders says the increase is an indication that lower mortgage rates. Attractive borrowing costs has had a stronger impact on some buyers’ perceptions of affordability than rising home prices.

Nonetheless, it is important to keep in mind that most home buyers (72%) still say they can afford only a minority of the homes available in their markets.

Here are the Stats:

Between the third quarters of 2019 and 2020…

- The share of buyers who can afford half or more of the homes available rose most significantly among Millennials (17% to 31%)

- Dropped among Boomers (23% to 19%).

- The most significant share rose significantly in the Northeast (21% to 39%),

- Affordability dropped in the Midwest (23% to 19%).

Show Prep Source:

http://eyeonhousing.org/wp-content/uploads/2020/10/HOUSING-TRENDS-REPORT-Q320.pdf